san francisco payroll tax and gross receipts

Proposition F fully repeals the Payroll Expense. According to the City and County of San Francisco this.

Annual Business Tax Returns 2021 Treasurer Tax Collector

Marsh co-managing shareholder of the San Francisco office and co-chair of the.

. Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. Proposition F fully repeals the Payroll Expense Tax and increases the. Since 2012 San Francisco has undergone many changes with its payroll and gross receipts taxation.

Since 2012 San Francisco has undergone many changes with its taxation of payroll and gross receipts. Treasurer Tax Collector Effective 1121 Prop F. In an effort to eliminate this perceived tax disincentive in November 2012 San Francisco voters passed Proposition E Prop E enacting the Gross Receipts Tax which.

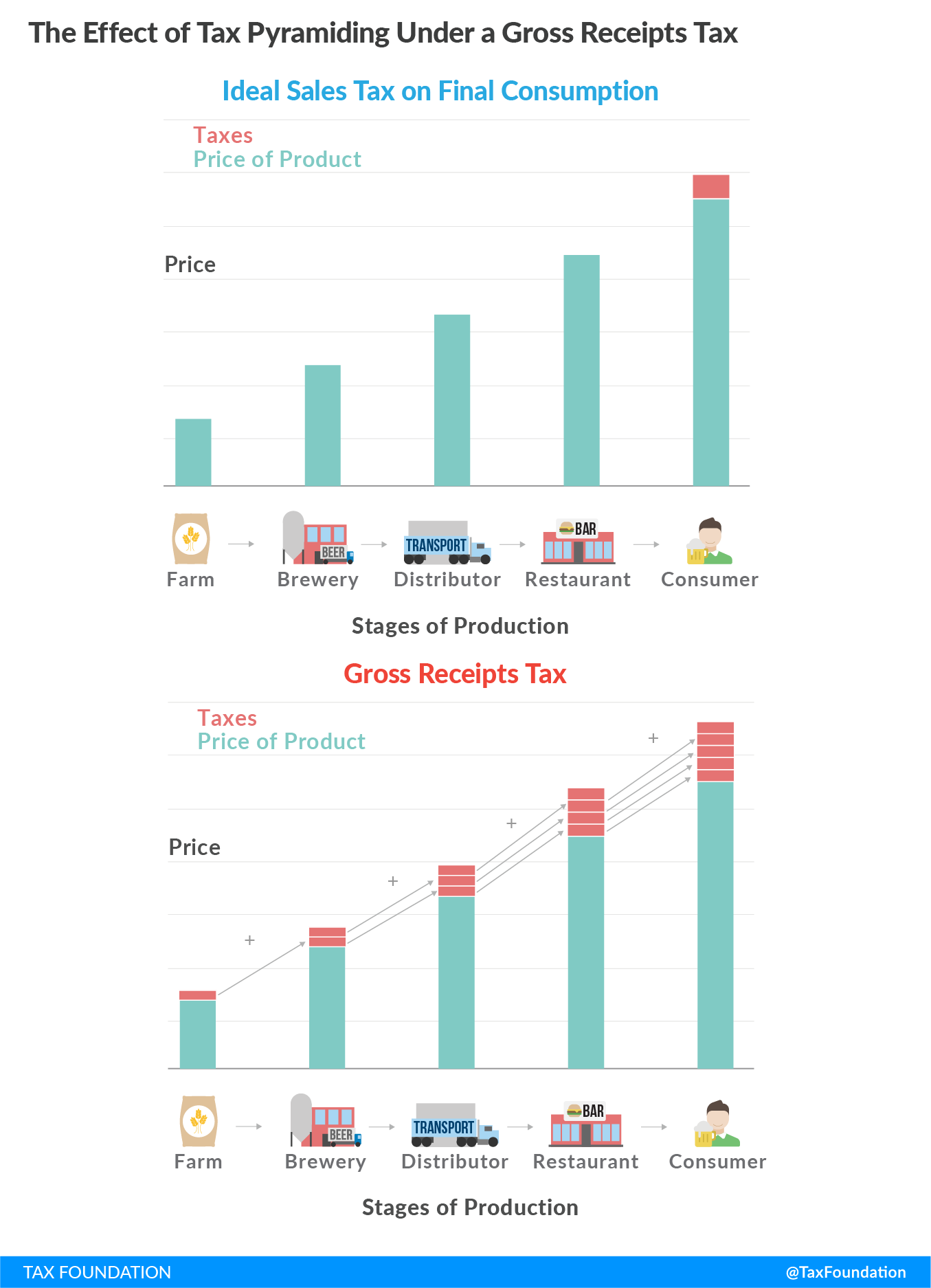

For the 2018 tax year a business may still be subject to both the San Francisco Payroll Expense Tax and the Gross Receipts Tax. The gross receipts tax rates vary depending on the type of business and the annual gross receipts from business activity in the city. Also known as the Homelessness Gross Receipts Tax there are few who are exempted from the Prop C tax.

From imposing a single payroll tax to adding a gross receipts tax. Businesses with less than 2M in gross receipts do not need to file their Annual Business Tax Return or pay Gross Receipts Tax. Given the breadth of San Franciscos definition of.

Starting with a single payroll tax weve seen a transition adding. 16 2022 Global law firm Greenberg Traurig LLPs Bradley R. The city of San Francisco is in the midst of transitioning from a payroll tax previously its main source of tax revenue to one favored by many other large citiesa tax on.

The Gross Receipts Tax has a small business. Payroll Expense Tax PY Proposition F was approved by San Francisco voters on November 2 2020 and became effective January 1 2021. The City began making the transition to.

SAN FRANCISCO Nov. Therefore when you register for a San Francisco Business License you will become obligated for these local taxes. If the executive pay ratio exceeds 1001 then an additional tax will be imposed on apportioned San Francisco gross receipts ranging from 01 to 06 depending on the computed.

The ordinance replaces the existing payroll expense tax on the privilege of doing business in san francisco with a tax that is based on gross receipts from business. Businesses operating in San Francisco pay business taxes primarily based on gross receipts. Gross receipts and payroll taxes.

Gross Receipts Tax Rates.

Sf Voters Approve First In The Nation Ceo Tax That Targets Inequality Calmatters

Taxpayers Reminded San Francisco Gross Receipts Tax And Payroll Expense Tax Due On Feb 29 2016 Corporate Tax United States

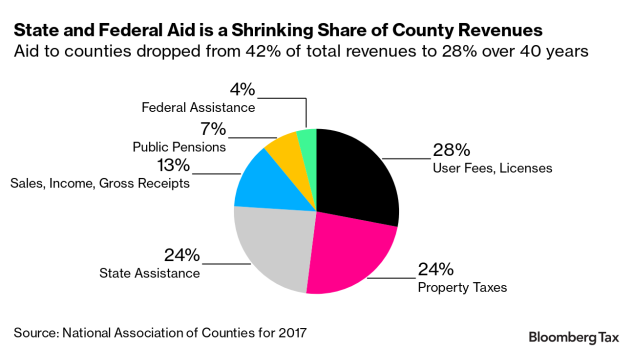

Charts Of The Week Government Reform Municipal Taxes And Teacher Diversity Across The Us

San Francisco Gross Receipts Tax

San Francisco Gross Receipts Tax Clarification

In Liberal San Francisco Tech Leaders Brawl Over Tax Proposal To Aid Homeless The New York Times

Revenue Squeeze Pushes Cities Counties To Get Creative On Taxes

Are San Francisco Companies Overpaying City Taxes Amid Covid 19 San Francisco Business Times

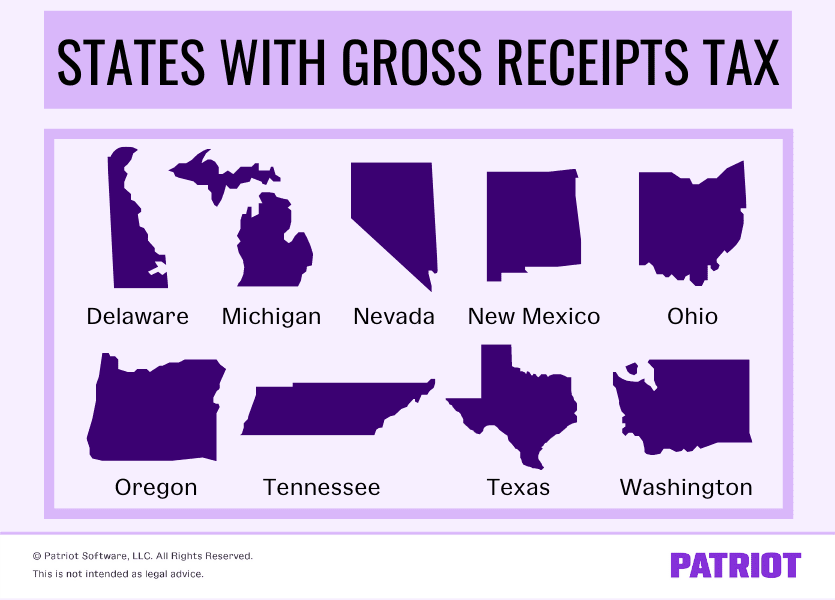

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_image/image/62216415/158129379.jpg.0.jpg)

San Francisco Has Passed A Tax On Big Businesses To Help The Homeless Vox

Working From Home Can Save On Gross Receipts Taxes Grt Topia

Have You Considered The Employee Retention Credit Bdo

Gusto Help Center San Francisco Payroll Expense Taxes

San Francisco Voters Approve Increases In Gross Receipt Taxes Bay Area Insurance Experts

![]()

Getting To The Core Of Gross Receipts Taxes Salt Shaker

San Francisco Payroll And Gross Receipts Tax Liability 101 Youtube

What Is Gross Receipts Tax Overview States With Grt More

Prop F San Francisco S Sweeping Business Tax Overhaul Wins Big